Angry investors called Musk to testify, accusing him of costing them millions of dollars in 2018 with false tweets about having funding secured to buy out shareholders at $420 per share.

Tesla’s stock price skyrocketed after Musk’s tweets, which shareholders claimed were reckless attempts to squeeze investors who had bet against Tesla.

A month after Musk purchased Twitter, he downplayed the impact of his tweets, saying that the price of Tesla’s stock went higher despite his tweets about it being too high.

Musk said in a thirty-minute testimony that would continue on Monday, “The causal relationship is clearly not there simply because of a tweet.”

“Tweeting something doesn’t mean people believe it or act on it,” Musk told the jury in federal court.

On Friday, plaintiffs called Harvard law and business professor Guhan Subramanian as an expert witness.

In a tweet, Musk proposed to take Tesla private, but he said it was “illusory” and “just wrong” due to how mega-deals usually unfold.

In response to a defense lawyer’s question about Musk’s tweets, Subramanian said: “This is just wrong; as a matter of deal process… this isn’t correct.”

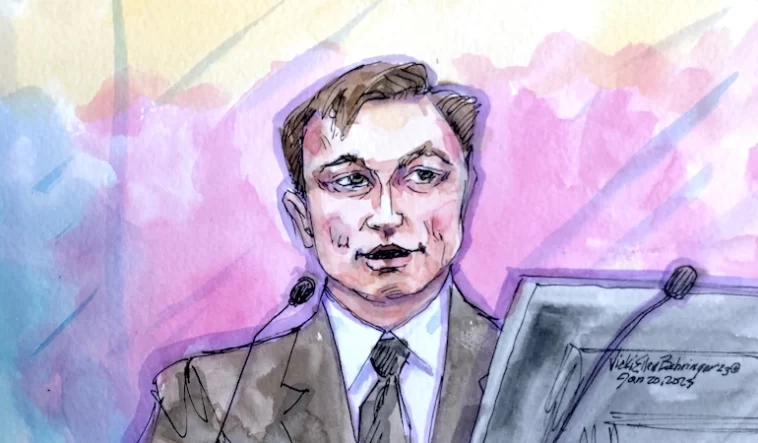

-Tesla CEO Elon Musk testifies during a securities-fraud trial in San Francisco, California, U.S., January 20, 2023 in this courtroom sketch. — Reuters